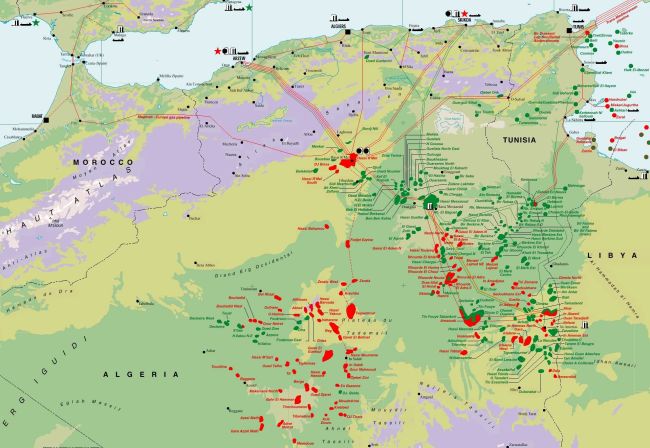

After nearly two years of widespread political and social transitions across North Africa, protest and labor movements have continued to expand in hopes of making the most of the new political environment. While motivations may vary, these groups are increasingly targeting the region’s energy sector in Libya, Tunisia and Algeria, commonly aiming their ire at foreign firms and their local subsidiaries.

After nearly two years of widespread political and social transitions across North Africa, protest and labor movements have continued to expand in hopes of making the most of the new political environment. While motivations may vary, these groups are increasingly targeting the region’s energy sector in Libya, Tunisia and Algeria, commonly aiming their ire at foreign firms and their local subsidiaries.

Against a backdrop of regional unrest, these energy-aimed efforts are to continuing to increase and beginning to threaten what many feel is North Africa’s quickest and surest route to recovery and post-Arab Spring stability.

In many cases, protests and labor strikes have taken issue with what is felt to be a lack of common benefit from the region’s rich oil and gas production. From Tunis to Benghazi, this has centered on the complaint that far too little of the region’s oil and gas wealth and revenue is reaching local communities.

A Post Arab Spring Analysis

In Tunisia, critics have taken issue with what they feel is a lack of work opportunities for local workers offered by the country’s most prominent energy outfit, BG and their local subsidiary BG Tunisia. Facing a 17.6 percent post-revolution unemployment rate, Tunisia has been unable to keep up with and absorb the growth in increasingly skilled young workers, according to a World Bank report.

Facing a similar demand for more work opportunities, but without the spike in skilled labor, Libya has seen protest movements target oil and gas facilities across the country, including a December strike at one of the country’s busiest oil and gas ports, Ras Lanuf. Protestors began the New Year with a strike at the Zueitina oil terminal, situated just east of Tripoli. According to the country’s Oil and Gas Minister, Abdul Bari Laroussi, the shutdown has come with a demand to employ 1,500 local residents and cost the country an estimated $1 million a day in lost revenue.

Additionally, Libya has seen protest groups use energy facilities to voice concerns about a variety of issues, most notably political representation. Shortly before the country’s first post-revolution election, armed militias occupied refineries in El-Sider, Ras Lanuf and Brega, shutting down half of the country’s export capacity. Their actions were aimed at increasing the number of seats reserved for the country’s oil-rich eastern provinces and shifting more authority over energy issues to the city of Benghazi.

Despite having largely escaped the kind of public protests that led to political transitions across the region, Algeria has faced its own share of protests aimed at the incredibly valuable oil and gas sector. Even before the Arab Spring protests began, Algeria faced a pushback from the country’s large number of unemployed for what they felt to be a lack of opportunities for local workers. Undoubtedly the country’s largest economic force, Algeria’s oil and gas production accounts for 98 percent of their export revenue and a large percentage of government funding. State efforts to curb these protests through increasing government incentives spending and a tighter security environment have worked in the short term. However, protests have continued to flare up as resentment builds around a lack of benefits seen across the country as well as wider uncertainty about what will follow the expected retirement of President Abdelaziz Bouteflika before scheduled elections in 2014.

According to a Bloomberg report, dwindling oil reserves and uncertainty have made the country’s relative calm difficult to sustain.

“Pacification through finance can’t go on forever,” Azzedine Layachi, a professor of international and Middle East affairs at St. John’s University in New York and Rome, told Bloomberg. “Everything is in shutdown mode until 2014 and that’s when we’ll see what direction Algeria takes.”

An Uncertain Landscape for Foreign Investors

In all three national cases, further labor unrest and protests aimed at energy sector actors could have a significant effect on the ability to attract much-needed investment and interest from foreign firms. In Libya, this means the ability to promote the full return of companies that halted operations in the midst of the civil violence that brought down the government of Muammar Gadaffi and move beyond pre-conflict levels to ensure future growth. While Tunisia is putting less emphasis on energy reserves as a means of economic recovery, continuing unrest does threaten to put off further investment from companies like BG, which provides over half of the country’s natural gas demand.

Last year, sit-ins at processing plants spurred talks between the company and local leaders, concluding in pledges for greater attention to local hires, including training options. Recently the company has said that while they would not consider leaving the county as a result of the sit-ins, they did not see themselves in a wider labor role.

“We continue to work in Tunisia and to explore new opportunities. Although the phenomenon of sit-ins and strikes is annoying, the group will not leave the country for all that,” Sami Iskander, Executive Vice-President and Managing Director of BG, Africa, Middle East and Asia told the Tunisian News Agency, but added, “the main purpose of the group is the production and supply of gas in the country and not creating jobs.”

Currently BG provides about 60 percent of Tunisia’s natural gas demand and employs about 1,000 employees.

Finally, further unrest in Algeria could prove troubling to the government’s recent push towards introducing unconventional shale exploration efforts to the country. Boasting significant domestic potential, Algeria will have to first deal with significant foundational investments associated with the shale excavation process in terms of both machinery and technical expertise. To help cope with these early expenses, the national government and the state-backed Sonatrach have unveiled new revenue sharing agreements and taxing schemes aimed at appealing to foreign investors with shale experience. Already known as a risky investment in the region, Algeria could prove even more uninviting if protests and strikes continue to expand.

So far, these protests have elicited little more from state officials than targeted actions according to each, specific case. However, according to the Agence France-Presse, Libya’s Prime Minister Ali Zeidan has threatened to impose “order by force” in to address those actions that threaten the country’s energy sector.

“Oil is our only source of revenue,” he said, according to the AFP report. “We will not allow any (armed) force to confront the people and threaten national security. I warn families, tribes and regions that we will take decisive measures.”

While Tripoli’s hard line may prove effective in garnering local support, it is far less clear whether it will provide the sense of stability needed for foreign firms to return to the region.

Image: The Australian

Originally Posted in Newsbase’s AfrOil Monitor